2022-23 October Federal Budget Breakdown

With the recent Federal Budget announcement, we wanted to take some time to break it down for you. Covering everything that was put into the spotlight including; superannuation and self-managed superannuation funds, personal taxation changes, social security, families, aged care, and right through to housing affordability.

So, let’s get right into what we’re looking at from the announcement!

Superannuation

Reducing the qualifying age for downsizer contributions to 55 years old

- Proposed Effective Date: 1 January, 1 April, 1 July, 1 October after Royal Assent

Currently, downsizer contributions to superannuation can only be made by individuals aged 60 years or older (prior to 1 July 2022, the minimum qualifying age was 65). The Government is proposing to (further) lover this age to 55.

All other eligibility criteria for downsizer contributions remain the same.

Relaxing Residency Requirements for Self-Managed Super Funds

- Proposed Effective Date: 1 July or after Royal Assent

The previous Government announced in the 2021-22 Federal Budget the proposal to relax the residency requirements for self-managed superannuation funds (SMSFs) and small APRA-regulated funds (SAFs) from 1 July 2022, however, this was not legislated. The current Government has affirmed its intention to proceed with this previously announced measure, albeit with a deferred start date.

Broadly, the measure:

- Extends the central management and control test safe harbour from two to five years for SMSFs, and

- Removed the active member test for both SMSFs and SAFs

Taxation – Personal

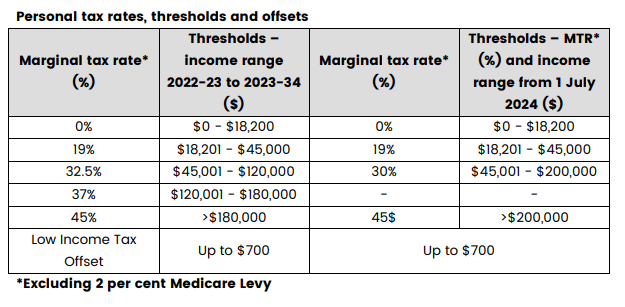

Proceeding with previously legislated changes to tax rates

- Proposed Effective Date: 1 July 2024

No change was announced to the previously legislated tax cuts, including ‘Stage 3’, which are to become effective from 1 July 2024.

Additional Notes: in 2022-23 and 2023-24 effective tax-free thresholds for individuals remain as:

- Individuals below Age Pension age: $21,884

- Individuals of Age Pension age, eligible for Seniors and Pensioner Tax Offset (SAPTO):

- Single $33,088

- Member of a couple (each) $29,783

- Illness separated couple (each) $32,088

These thresholds include the $700 Low Income Tax Offset (LITO).

Social Security

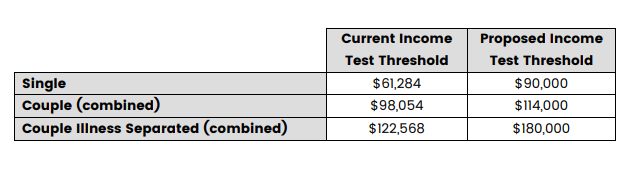

Increasing the income test threshold for the Commonwealth Seniors Health Card

- Proposed Effective Date: 7 days after Royal Assent

The Government proposes to increase the Commonwealth Seniors Health Card income test limits as per the table below:

Encouraging Workplace Participation by Pensioners

- Proposed Effective Date: Various

The Government proposes to introduce the following measures to incentivise pensioners to engage in paid employment.

1. Temporarily increasing the Work Bonus income bank

Under this measure, eligible pensioners and certain veterans’ entitlement recipients will have an extra $4,000 credited to their Work Bonus income concession bank balance. The maximum Work Bonus income concession bank balance will increase from $7,800 to $11,800 until 30 June 2023 and will reset to $7,800 on 1 July 2023.

Eligible individuals are those over Age Pension age who receive one of the following payments:

- Age Pension

- Disability Support Pension

- Carer Payment

- Equivalent Veterans’ Entitlement Act pension

The existing Work Bonus concession of $300 per fortnight will remain unchanged.

This measure commences on 1 December 2022 if the enabling legislation received Royal Assent before 25 November 2022, otherwise, 7 days after the Royal Assent.

2. Extending the qualification period for Pensioner Concession Cards

Currently, Age Pensioners have their Pensioner Concession Card cancelled 12 weeks after their pension ceases to be payable due to their level of employment income. Disability Support Pension recipients currently have their Pensioner Concession Card cancelled 52 weeks after they lose eligibility for the pension due to their employment hours or ordinary income from employment.

This measure extends the period that working pensioners, and their pensioner partners, can remain qualified for a Pensioner Concession Card for up to two years after their payment ceases.

This measure commences on the later of 1 January 2023 and one more after Royal Assent of the enabling legislation.

3. Suspending, instead of cancelling, benefits and entitlements for up to two years

Age Pensioners and certain veterans’ entitlement recipients will have their payment suspended for up to two years, instead of cancelled, if their income, which includes some income from the recipient’s own employment, precludes payment. The suspension will also be made available to their partners, and partners of Disability Support Pension recipients.

This will enable pensioners and their partners to resume receiving pension more easily if it becomes payable again within two years.

This measure commences on the later of 1 January 2023 and one month after Royal Assent of the enabling legislation.

Incentivising Pensioners to Downsize

- Proposed Effective Date: the later of 1 January 2023 or one more after Royal Assent

Legislation is before Parliament intended to reduce the financial impact on pensioners looking to downsize their homes in an effort to minimise the burden on older Australians and free up housing stock for younger families.

This measure includes:

- Extending the social security assets test exemption for principal home sale proceeds for 12 months to 24 months for income support recipients; and

- Amending the social security income test, to apply only the lower deeming rate (currently 0.25%) to principal home sale proceeds when calculating deemed income for up to 24 months after the sale of the principal home.

Freezing of deeming rates

- Proposed Effective Date: Immediate

The Government will freeze social security deeming rates at their current levels until 30 June 2024.

The lower deeming rate will remain frozen at 0.25% and the upper rate will remain at 2.25%.

Lowering the Pharmaceutical Benefits Scheme (PBS) general co-payment

- Proposed Effective Date: 1 January 2023

The Government will reduce the maximum general co-payment for medications on the Pharmaceutical Benefits Scheme (PBS) from $42.50 per script to $30 per script.

Families

Enhancing the Paid Parental Leave Scheme

- Proposed Effective Date: 1 July 2023 onwards

Currently, the Paid Parental Leave scheme comprises of two payments for eligible carers of a newborn or recently adopted child:

- Parental Leave Pay of up to 18 weeks at a rate based on the national minimum wage to the primary carer; and

- Dad and Partner Pay of up to 2 weeks at a rate based on the national minimum wage to fathers and partners.

The Government proposes to introduce greater flexibility to the Paid Parental Leave Scheme from 1 July 2023 by:

- Combining Parental Leave Pay and Dad and Partner Pay into a single 20-week payment;

- Introducing a family income limit of $350,000 which families can be assessed under if they do not meet the individual income test ($156,647 for the 20221-22 financial year);

- Enabling either parent to claim the payment;

- Allowing both birth parents and non-birth parents to receive the payment if they meet the eligibility criteria; and

- Allowing parents to take leave at the same time while claiming weeks of the payment concurrently.

From 1 July 2024, the Government will start expanding the scheme by two additional weeks a year until it reaches a full 26 weeks from 1 July 2026.

Further, both parents will be able to share the leave entitlements, with a proportion maintained on a “use it or lose it” basis, to encourage and facilitate both parents to access the scheme.

Increasing the Child Care Subsidy (CCS)

- Proposed Effective Date: 1 July 2023

The Child Care Subsidy is a percentage-based subsidy based on the family income that assists with the cost of child care.

The Government proposes that:

- Increase the maximum CCS rate from 85% to 90% for families earning less than $80,000

- Increase the CCS rate for all families earning less than $530,000 in household income. Specifically, the CCS subsidy rates will taper down one percentage point for each additional $5,000 in income above $80,000 until it reaches 0% for families earning $530,000

- Maintain current higher CCS rates (up to 95%) for families with multiple children aged five and under in care

Aged Care

Increasing funding to and improving aged care

- Proposed Effective Date: Various

Once again the Government has allocated additional funding and proposed reform to the aged care sector.

The announcement measures include:

- Spending to establish an aged care complaints commissioner, introducing new financial reporting requirements, supporting the sector in providing better food for residential and home care recipients and establishing a national registration and code of conduct for workers;

- Capping administration and management fees charged by providers in the Home Care Packages Program and abolishing exit fees;

- Improving the quality of care in residential aged care facilities by requiring all facilities to have registered nurse onsite 24 hours per day, 7 days a week from 1 July 2023 and increasing care minutes to 215 minutes per resident per day from 1 October 2024; and

- Improving aged care infrastructure and services that provide additional supports to older First Nations People, and older Australians from diverse communities and regional areas.

Housing Affordability

Establishing the Regional First Home Buyer Guarantee

- Proposed Effective Date: 1 October 2022

The Government proposes to establish the Regional First Home Buyers Guarantee (RFHBG) to support eligible citizens and permanent residents who have lived in a regional location for more than 12 months to purchase their first home in that location with a minimum of 5% deposit, with 10,000 places per year to 30 June 2026.

Other housing affordability measures

- Proposed Effective Date: Various

The Government has also proposed other housing affordability measures including:

- $10 billion to be invested in the newly created Housing Australia Future Fund, to be managed by the Future Fund Management Agency. Investment returns will be used to fund:

- Construction and repairs of housing in remote Indigenous communities;

- Transitional and crisis accommodation for women and children fleeing domestic and family violence and housing for older women; and

- Housing and specialist services for veterans who are at risk of homelessness.

- Other programs and measures include:

- Establishing a ‘Help to Buy’ scheme to assist low and middle-income earners to purchase a new or existing home using equity supplied by the Government;

- Funding for research into the provision of affordable housing and developing the housing supply;

- Reducing the superannuation downsizer contribution minimum to eligibility age to 55 (from the current age of 60); and

- Extending the social security asset test exemption for sale proceeds for pensioners who have sold a home to up to two years and capping deeming on these proceeds at the lower deeming rate, currently 0.25%.