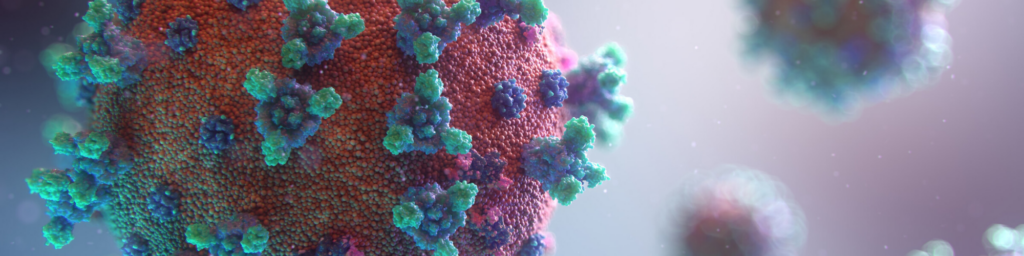

COVID-19 // Economic Stimulus + Survival Guide

The Federal Government and State Government have together announced multiple stimulus packages to help support everyone affected by Covid-19 [Corona Virus].

Christmas + FBT

FBT is payable by employers on the value of certain benefits that have been provided to their employees in respect of their employment.

Deceased Estates

When a person dies, there are some important tax and superannuation issues for the executor and the beneficiaries, including

Cars + Running Expenses

Did you know transport is the second largest expense after housing, equating to almost 14% of household budgets?

Cyber Security – How Not To Be An April Fool

Every year thousands of Australians have their identities stolen. Criminals use stolen personal information to commit identity crimes.

Discretionary Trusts + Keeping It In The Family

A family trust is a form of a Discretionary Trust and one of the most important investment vehicles that individuals can look at starting.

We Bring Home an International Award

Directors, Amanda Wilkens and Krystine Canny-Smith and Manager Helen Yau travelled across the globe to San Diego in November to take part in the conference.

Taxable Payments Annual Reporting (TPAR)

Commencing 1 July 2018 if you operate a business which provides cleaning services or courier services you will now need to report to the Australian Taxation Office

5 Steps To Help You Understand If Your Business Is Performing

It is easy to be trapped into thinking you are making money whilst there are lots of transactions both in and out and you get caught up in the day to day operations of your small business.

Motor Vehicles + Fringe Benefits Tax

Before buying a company car for your business, it is very important to take into account any possible motor vehicle fringe benefit implications.